First-time homebuyers need a comprehensive plan for success. This includes assessing financial health, understanding borrower requirements, strategically searching for properties, and navigating key steps like pre-approval, offer submission, inspection, and closing. A well-planned strategy ensures informed decisions, competitive access to listings, and a smooth transition to homeownership.

In the competitive real estate market of today, crafting a successful buying experience as a first-time purchaser is an art. Many enter the process with enthusiasm but are soon daunted by the complexities and uncertainties ahead. This comprehensive guide aims to empower new buyers with a step-by-step strategy, ensuring they navigate this journey confidently. We’ll dissect the challenges, from understanding market dynamics to securing financing, and offer practical solutions. By the end, readers will possess the knowledge and tools to create a seamless, informed experience, setting them on the path to achieving their dream of homeownership.

Prepare Your Financial Foundation: A Comprehensive Plan

For first-time homebuyers, creating a solid financial foundation is the cornerstone of a successful journey into homeownership. This involves a meticulous process that goes beyond securing a mortgage; it entails understanding and meeting borrower requirements, fostering prudent financial habits, and developing a strategic plan for long-term stability. A comprehensive plan should address various aspects, from assessing one’s financial health to navigating the complexities of the real estate market.

The initial step is evaluating your current financial situation. This includes assessing your income, liabilities, and savings. For instance, calculating your debt-to-income ratio is crucial as lenders often use this metric to determine affordability. A rule of thumb suggests keeping this ratio below 36%. Additionally, building an emergency fund is essential; experts recommend saving at least three to six months’ worth of living expenses, providing a buffer against unforeseen circumstances.

Once your financial house is in order, it’s time to explore borrower requirements in depth. Lenders will scrutinize your credit score, employment history, and down payment savings. Maintaining or improving your credit score (ideally above 740) can significantly impact the interest rates offered. According to recent data, borrowers with excellent credit scores often secure rates as low as 2.5%, saving them thousands over the life of their loan. Furthermore, a substantial down payment (typically 20%) not only reduces the amount borrowed but also signals to lenders that you are a responsible borrower committed to long-term financial stability.

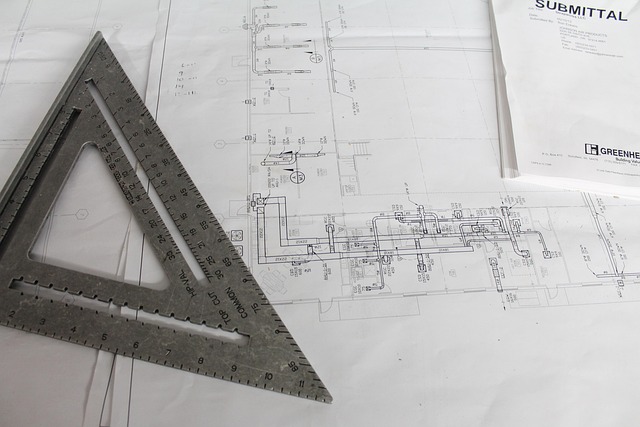

Search Strategically: Finding the Right Property for You

When embarking on your first property purchase, a strategic search is paramount to finding a home that aligns with your needs, preferences, and financial capabilities. This involves more than just scrolling through real estate listings; it requires a systematic approach to uncover hidden gems and avoid common pitfalls. A comprehensive plan tailored to your unique circumstances will serve as your compass throughout the process.

Start by defining your borrower requirements: budget constraints, desired location, property type (condo, single-family home), and any specific amenities or features important to you. For instance, first-time homebuyers in urban areas might prioritize proximity to public transportation and walkability, while those seeking a quieter suburban lifestyle may focus on school districts and outdoor spaces. Utilizing online tools to create a detailed profile based on these criteria can streamline your initial exploration. Websites offering advanced search filters allow you to narrow down options swiftly, ensuring you don’t waste time viewing properties that don’t meet your essential needs.

Once armed with a clear understanding of your requirements, delve deeper into the market trends in your desired locations. Property values and rental rates fluctuate based on various factors, including economic conditions, local development projects, and demographic shifts. Accessing current data through reputable sources provides insights into areas with potential growth or established stability. For example, examining historical property value appreciation rates can help identify neighborhoods poised for future gains, influencing your decision to purchase early.

Engaging the expertise of a seasoned real estate agent is invaluable during this phase. They not only offer market knowledge but also guide you through the legal and financial complexities of homeownership. A good agent will listen attentively to your comprehensive plan borrower requirements and provide tailored recommendations, facilitating access to properties that might otherwise remain hidden. Their connections within the industry can unlock exclusive listings, ensuring a competitive edge in what can be a fast-moving market.

Navigate the Buying Process: From Offer to Keys in Hand

Navigating the home buying process can be an intimidating journey for first-time borrowers. This comprehensive plan is designed to guide you through each step, ensuring a smooth transition from finding your dream home to moving in with keys in hand.

The initial phase involves pre-approval, a crucial step in understanding your borrower requirements and securing financing before making an offer. Gather your financial documents and consult a mortgage professional who can help determine your budget and pre-qualify you for a loan. This provides peace of mind and helps you compete effectively in a competitive market. Once pre-approved, start viewing properties, keeping an eye on the local real estate trends. Researching the area, schools, amenities, and property values will empower you to make informed decisions aligned with your borrower requirements.

Making an offer is the next critical step. Consider factors like property condition, comparable sales data, and market conditions. Present a strong offer backed by your pre-approval status. During negotiations, be prepared to discuss price, closing costs, repairs, and any other contingencies. Once accepted, you’ll enter the inspection phase where a professional assesses the home’s condition. This step is vital in understanding potential repair needs and negotiable items. If issues are discovered, you can re-negotiate or proceed with caution.

After successfully completing inspections and addressing any concerns, it’s time to move towards closing. Here, your lender finalizes your loan, and you’ll need to review all documents carefully. This comprehensive plan involves active participation to ensure the process aligns with your borrower requirements and expectations. On closing day, you’ll sign the necessary paperwork, pay the remaining balance, and officially become a homeowner.